[Essential Knowledge] Introduction to Options and Low-Risk Strategies

1. Concept

Call, Bullish Option

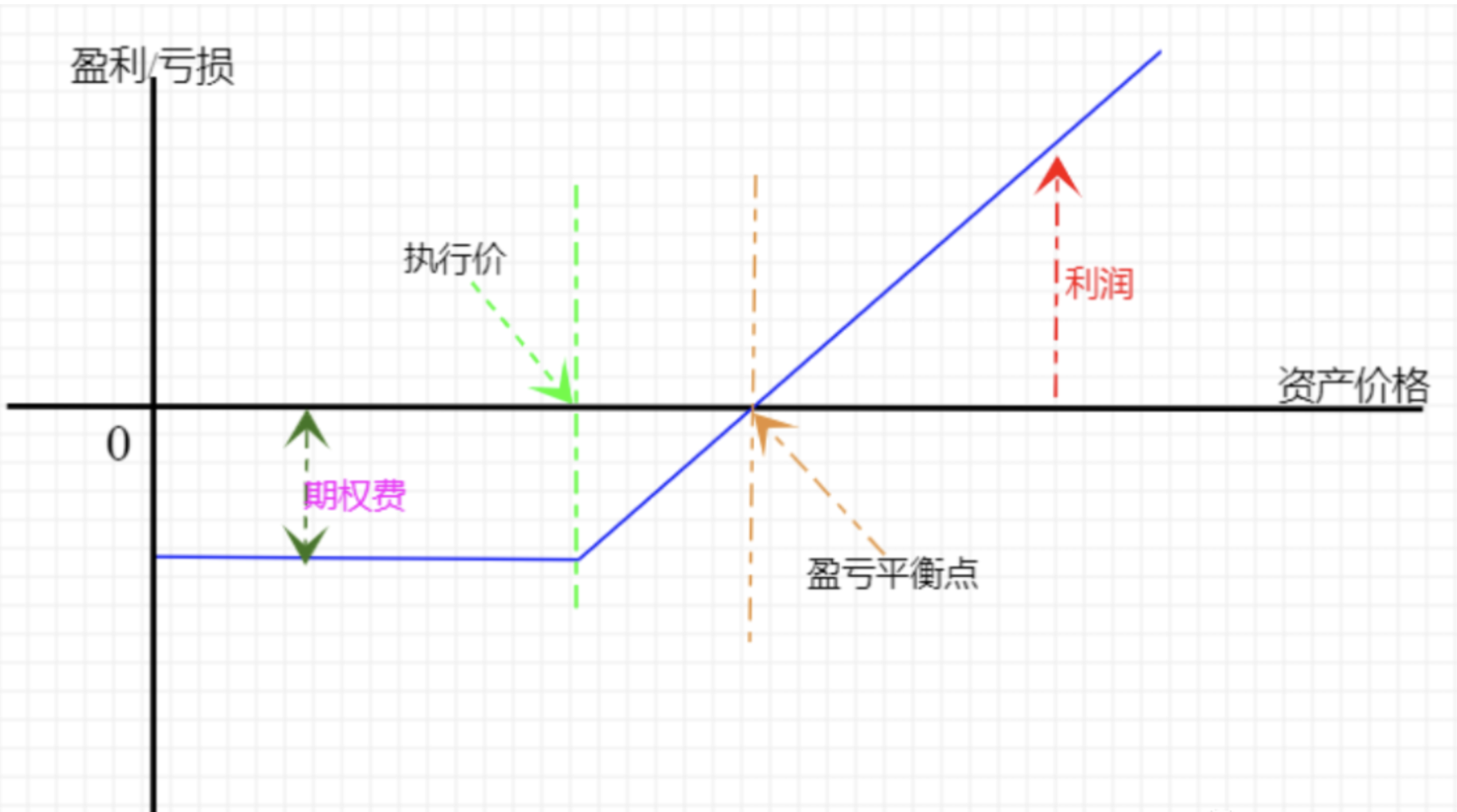

① Buying Call Options

The definition of buying call options (also called subscription options) is: When expecting the underlying price to rise, investors can choose to buy call options to use less capital (option fees) to gain leverage from the rise in the underlying price.

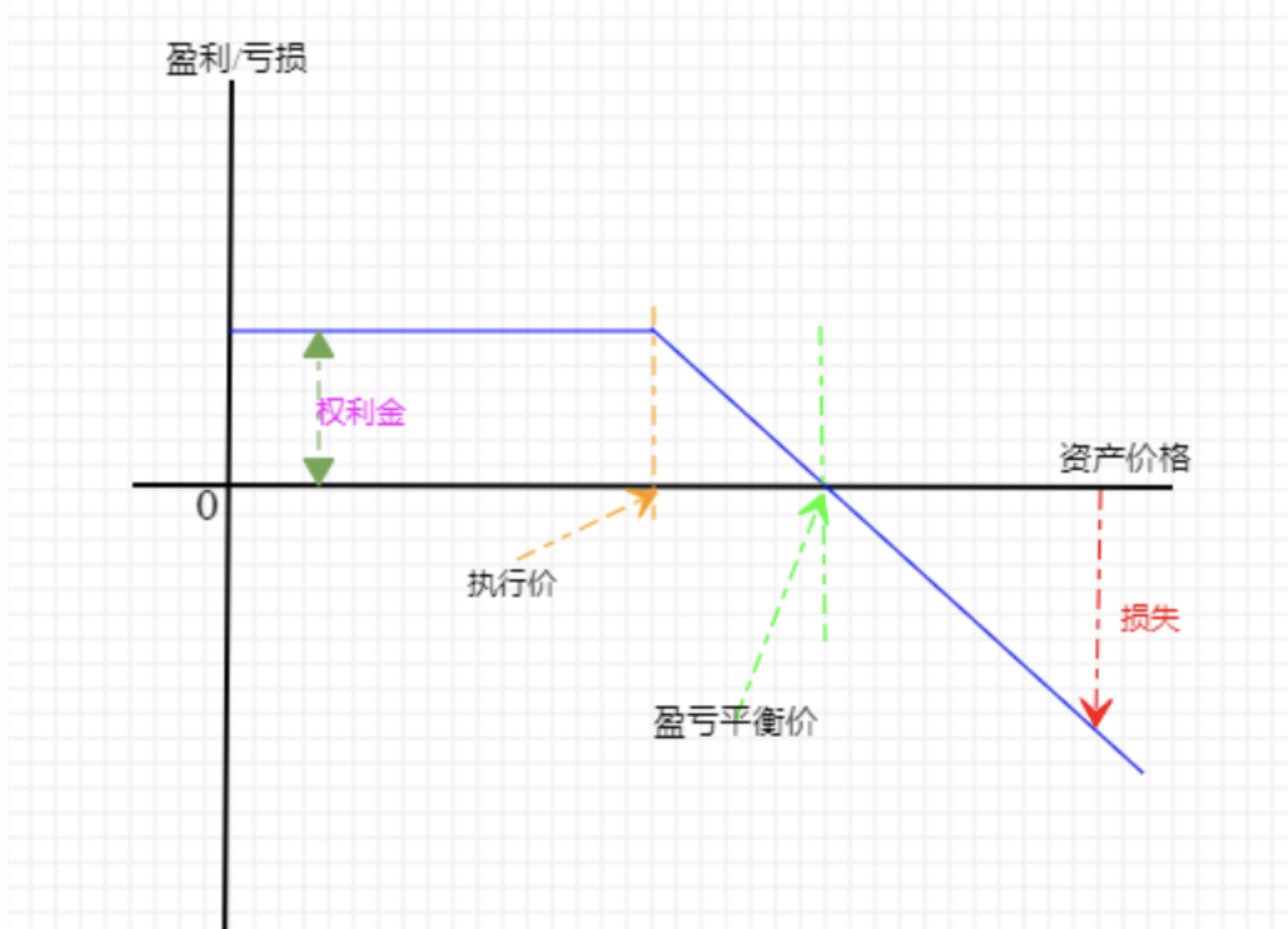

② Selling Call Options

The definition of selling call options is: When expecting the underlying price to fall slightly or rise, one can choose to sell call options to earn the premium income.

Put, Bearish Option

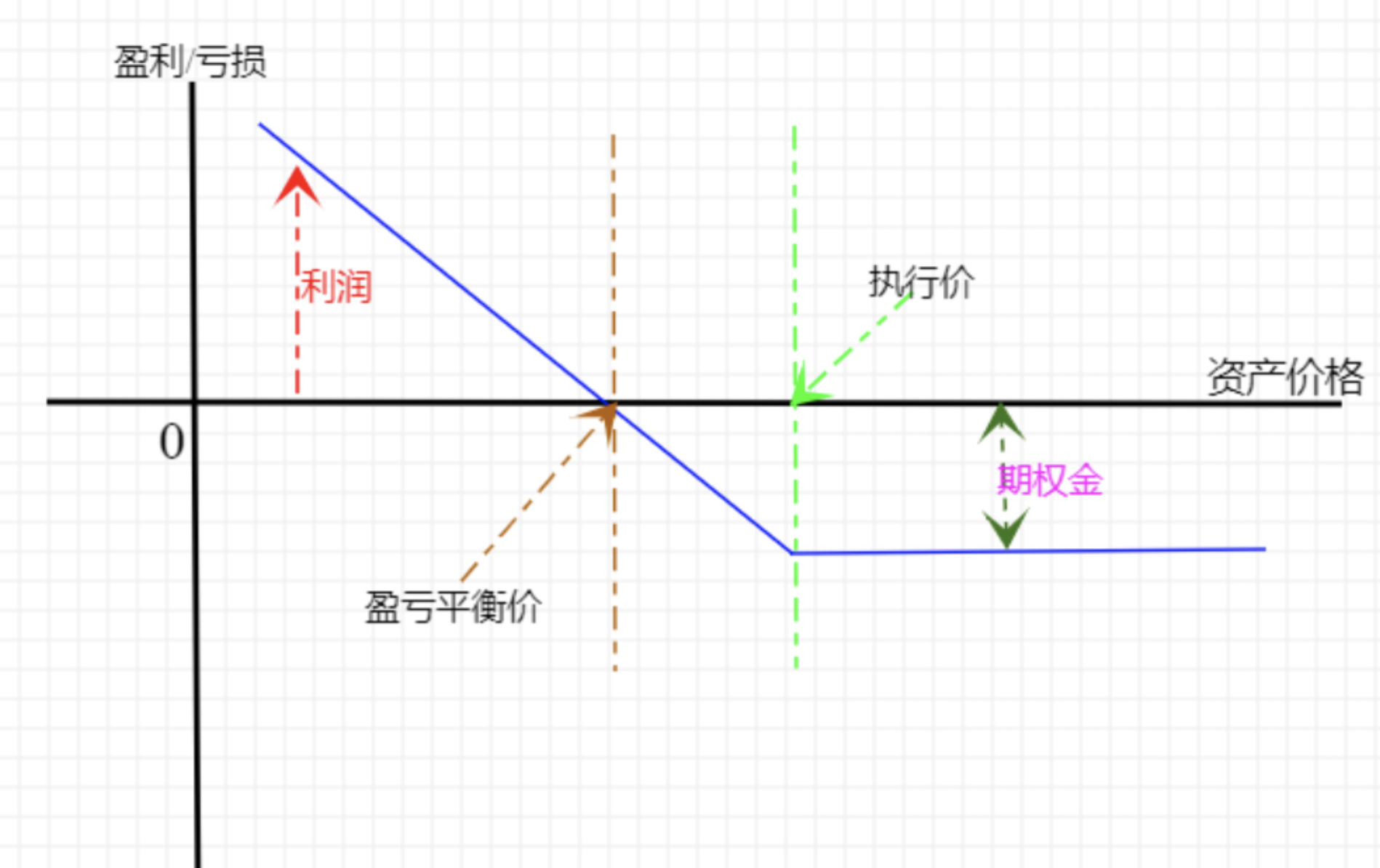

① Buying Put Options

The definition of buying put options is: When investors expect the price of the underlying securities to fall, they can choose to buy put options.

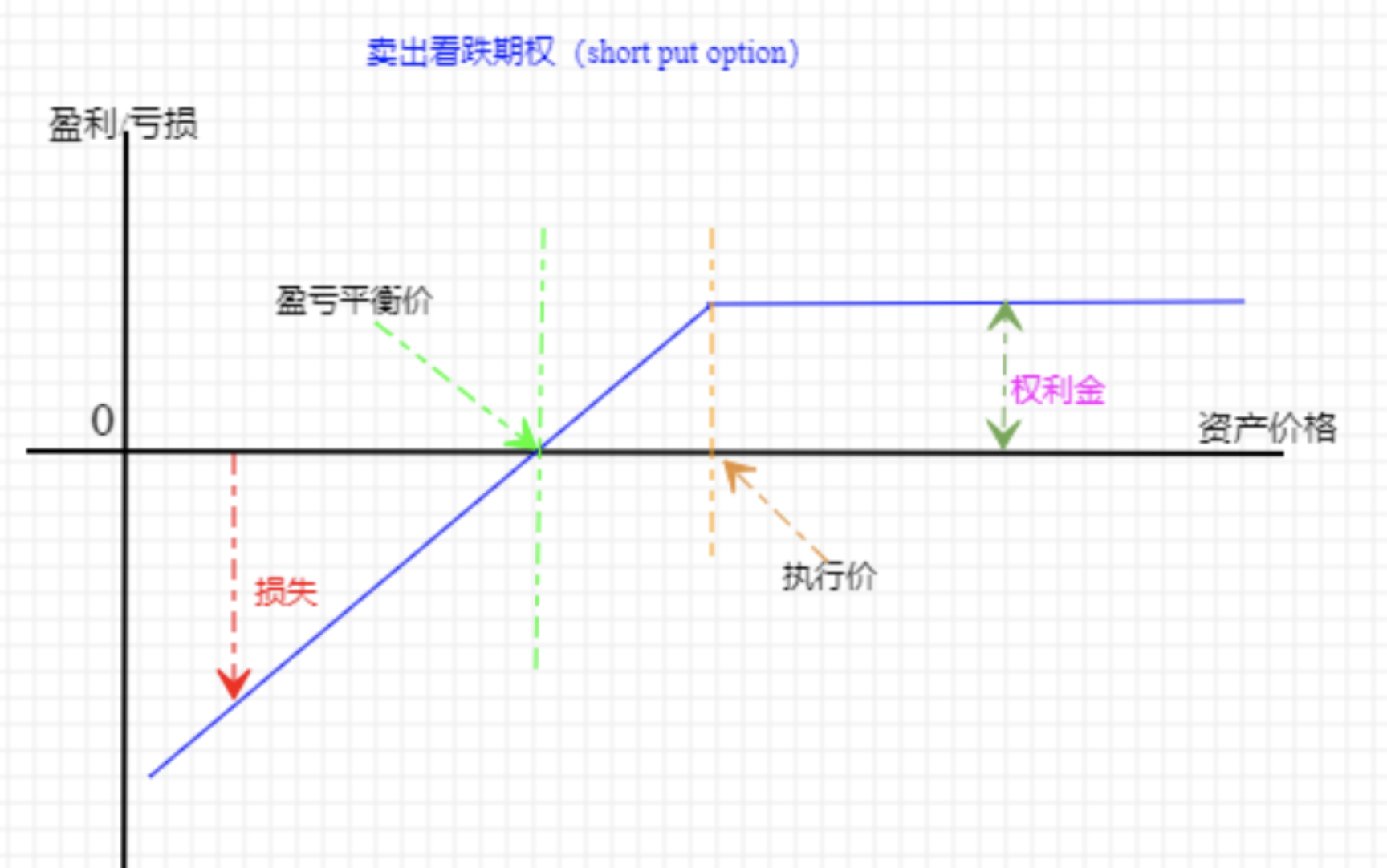

② Selling Put Options

The definition of selling put options is: When the future price of securities is not expected to fall, investors can sell put options to earn premium income.

2. Covered Options

Covered Options: When investors hold equivalent and opposite positions in the underlying asset while selling options.

When an investor owns the underlying asset and issues a call option, so that when the option is exercised, the underlying asset can be sold to the option holder at any time, a covered call option appears.

When an investor sells a put option and has enough cash to pay the exercise price of the put option, a covered put option appears.

It is considered beneficial to use covered options because investors can profit from option premiums.

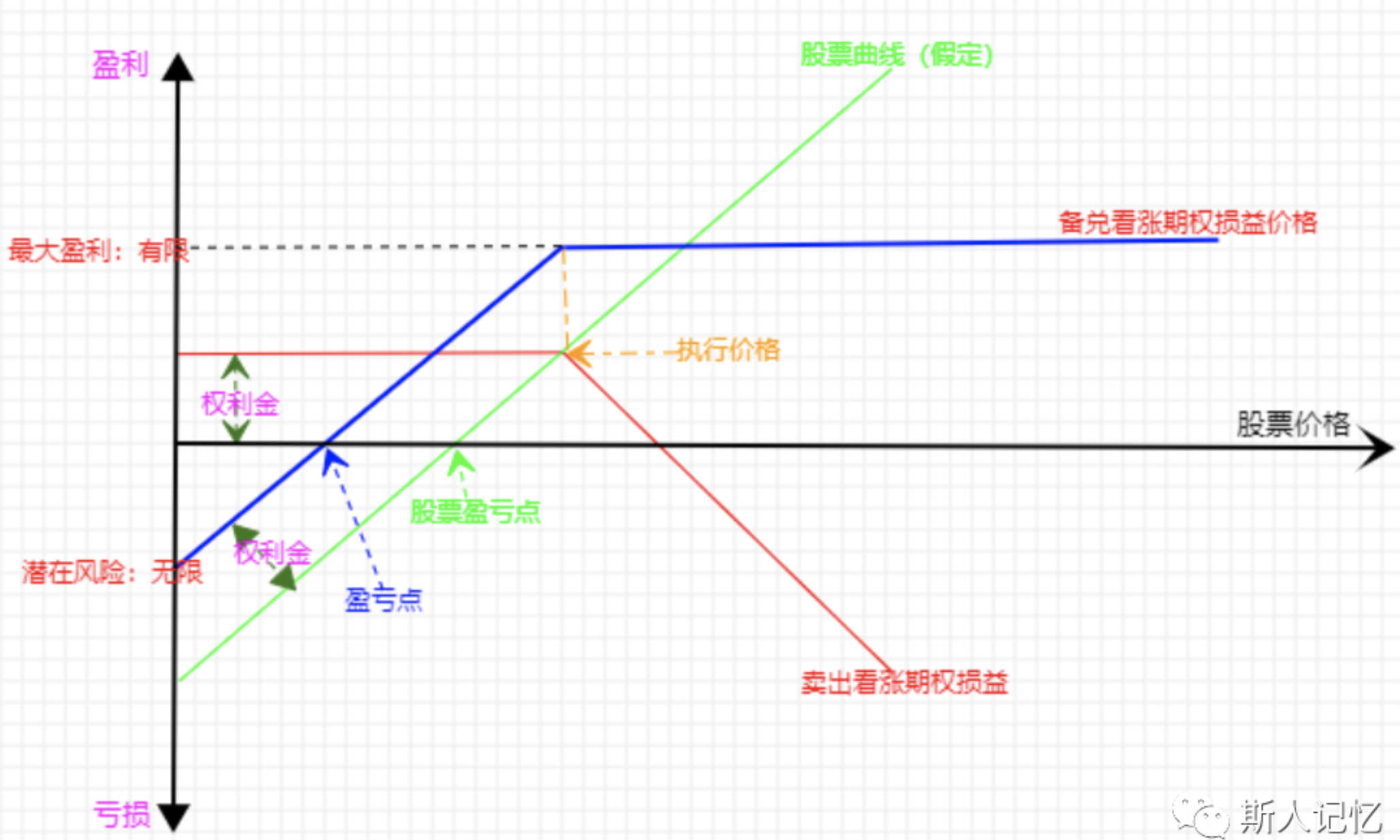

Covered Call Options

In most cases, [Buying Stocks + Selling Call] is a low-risk combination. Otherwise, selling call options directly is too risky. If the counterparty exercises, you have to buy the stock (if it continues to rise, in extreme cases, you may not be able to buy the stock, and the stock price may rise infinitely) and then sell it to the counterparty. Therefore, it is often paired with stocks.

For example, if Tencent Holdings’ price is 380 HKD/share, buying Tencent Holdings stock (N shares) while selling next month’s 410 HKD Call for 9 HKD, the purchase price is equivalent to (380-9) = 371 HKD. If Tencent’s stock price does not reach 410 HKD next month, you will earn 9*100=900 HKD in premium. If the stock price rises slightly to 390 HKD/share, the gain during the period is (390-371)*N. If the stock price falls below 380 HKD (assumed to be X HKD), the loss is (380-9-X)*N;

If it reaches 410 HKD and the counterparty exercises, you can sell the stock at 410 HKD. If it continues to rise, it has nothing to do with you anymore (actually, whether it rises or falls doesn’t matter because it has been sold).

Another example:

A trader buys 100 shares of Apple stock at $90 per share and sells a July 95 call option, earning $100 in premium.

There are several possibilities when the option expires:

Apple’s stock price is below 95. The call option expires worthless, earning the full $100, with stock earnings at 100x(x-90). If the stock price is 93, the stock profit is $300, and the premium earned is $100. Total earnings are $400.

Apple’s stock price is $100. The 100 shares of stock are sold at $95. Stock earnings are (95-90)x100=$500. The premium is still $100. Total earnings are $600. However, without selling the covered call, the stock profit would have been $1000.

If extreme bad news causes Apple’s stock price to fall to $50, the stock loss is 40x100=$4000. The option expires worthless, and the premium income is $100. The final total loss is $3900.

Therefore, we can see that the ideal state for a covered call is for the stock price to be below the exercise price at expiration, but not too low. It should not be higher than the exercise price. If the stock price rises too high, the upward space is limited due to the sold call option. If the stock price falls significantly, the hedge effect of the premium is also limited.

Therefore, this strategy is suitable for stocks with small price fluctuations, rarely soaring, and rarely plummeting. Regularly selling covered calls can provide stable cash income. If the stock itself has good dividends, it is called a double dividend.

Applicable Scenarios

When the underlying price is expected to remain flat or rise mildly, at least not fall, the profit and loss at maturity are consistent with selling put options.

For long-term investors, it can reduce the holding cost. As long as you hold the stock, you can sell a call every month.

Strategy Construction

Buy the underlying asset and sell call options proportionally.

Income/Risk:

The strategy’s income is limited, with the maximum profit being the exercise price minus the underlying price plus the premium income; the risk is unlimited (the risk of the held stock falling).

[Proposed lower price to buy the stock + selling Put is a common strategy for value investing]

Selling Put: Selling a put option is equivalent to selling a right, also commonly used by value investors (Warren Buffett is very good at it). For example, if Tencent Holdings’ price is 380 HKD/share and I expect the purchase price to be 330 HKD/share, selling for 3 HKD, then I sell next month’s 330 HKD exercise Put. If it falls to 330 HKD next month, I will exercise to buy, and the actual purchase cost is (330-3)=327 HKD. If it does not reach the exercise price, I will get the premium (3*100)=300 HKD.

Buying Call: Buying call options. In most cases, the person buying Call is not because they don’t have money to buy stocks (if they don’t have money to buy stocks, how can they exercise the call option when the stock price reaches the exercise price to buy the stock from the counterparty and sell it at the exercise price to get the stock price difference?).

Actually, most cases of buying Call are for short selling stocks’ stop-loss orders and technical buyers chasing price breakthroughs, which are mostly speculators in the market, contributing to lowering costs for value investors.

Buying Put: Buying put options. It is basically the opposite of buying Call and is mostly used for stop-loss orders when going long.

3. Master of Options: Warren Buffett

Buffett sells put options. For example, he expects to buy Coca-Cola shares (when the price is higher than $53) and expects it to fall to a certain price, $53. He continuously rolls out put options until the price reaches $53 or below and exercises to buy the stock. Continuously rolling out to get the premium reduces the actual purchase cost (purchase cost - premium income per share = actual purchase cost). Later, as Buffett’s capital increased, during the 2008 financial crisis, he chose S&P 500SPY options (large enough capacity) and sold tens of billions of put options (Buffett also sells long-term European put options, where European options can only be exercised on the expiration date, unlike American options that can be exercised at any time during the term, Buffett takes the premium to invest, similar to insurance float). https://www.bilibili.com/video/BV1SE411q7kz?spm_id_from=333.999.0.0

European Option: Only allows exercise on the expiration date; the SSE 50ETF option launched by the Shanghai Stock Exchange is a European option.

American Option: During the term, from the beginning to the end of the option contract, it can be exercised at any time.

Option Strike Price: The agreed price for future exercise.

premium, or called option fee

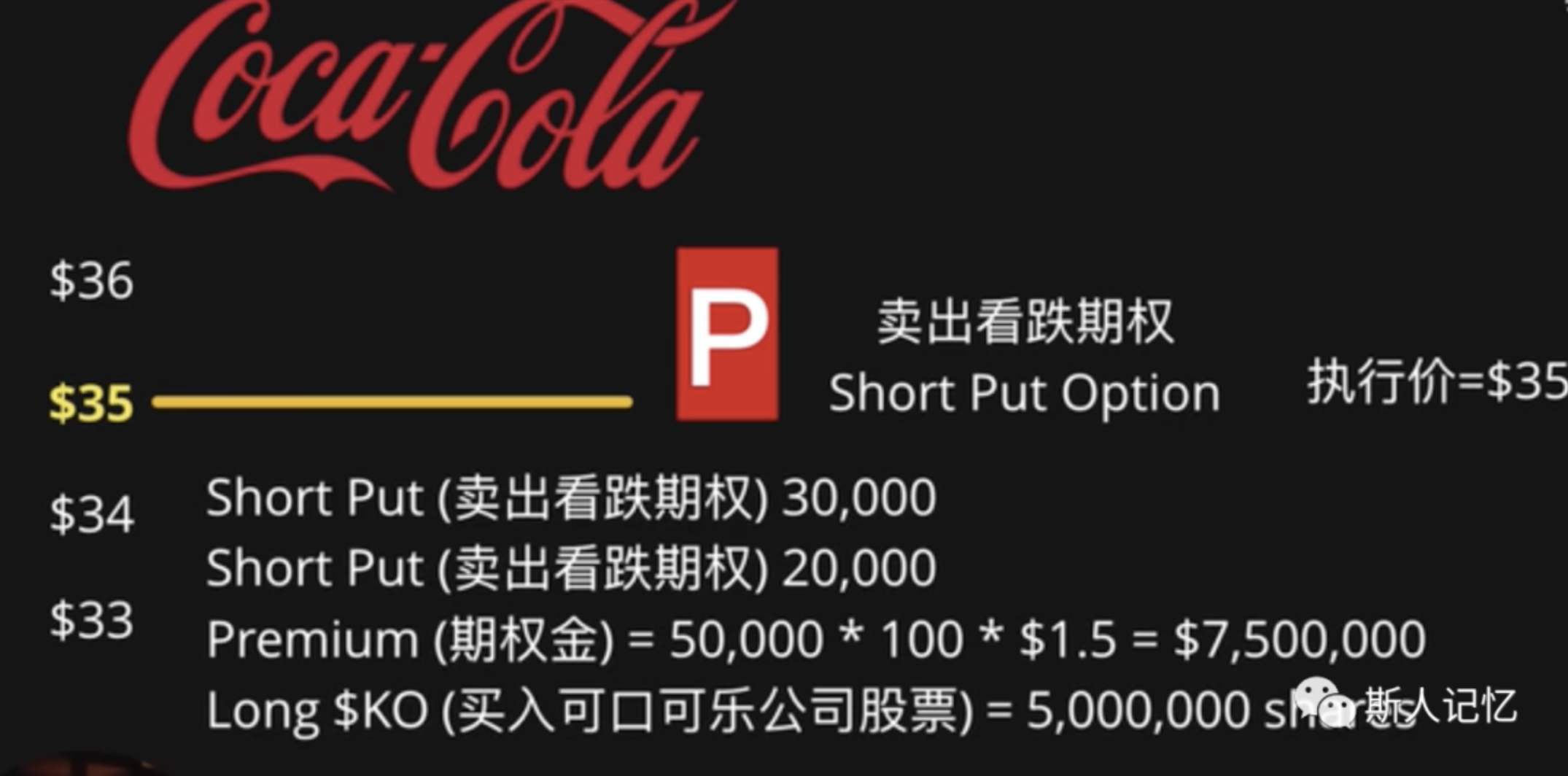

Bottomed out Coca-Cola in 93

Buy stocks + sell options

In April 1993, Buffett wanted to increase his holdings of Coca-Cola, but at this time the market price of Coca-Cola was about $40, and his psychological price for Coca-Cola stock was $35.

So, he sold 5 million put options expiring on December 17, 1993, with a strike price of $35 for a premium of $1.5, aiming to “buy low” Coca-Cola stock through put options.

December 17, 1993 (expiration date)

If Coca-Cola’s stock price is higher than $35, the sold put option becomes worthless and will not be exercised. The option becomes a piece of waste paper, and Buffett can get $1.5 * 5 million = $7.5 million in premiums;

If Coca-Cola’s stock price is lower than $35, the sold put option becomes an in-the-money option, and Buffett must buy 5 million shares of Coca-Cola stock at $35. Combined with the $1.5 premium received earlier, the final actual purchase cost of Coca-Cola stock for Buffett is $33.5 per share.

From this, it can be seen that if Coca-Cola’s stock price does not fall, Buffett can earn the premium; if Coca-Cola’s stock price falls sharply, the previously received premium equals a market subsidy of $1.5 to buy Coca-Cola stock, which is lower than Buffett’s psychological price.

Investors choosing to employ the strategy of selling put options may encounter two outcomes: receiving the premium or accepting delivery of the underlying security at the psychological price.

Summary

Buying stocks and selling calls is a low-risk combination.

Planning to buy stocks at lower prices and selling puts is a common strategy for value investors.

True experts or large funds often sell call or put options.

It’s not advisable to solely buy either calls or puts, as it could involve unlimited risks.

Related Content

- Buffett Reveals Ideal Investments if Starting Over at 30

- The Astonishing Pattern in Buffett's Past Sell-Offs! the Truth Behind the Unprecedented Massive Sell-Off Finally Revealed! Is a Major Crisis Imminent?

- State of Play in China:Why the CCP Desperately Wants to Reclaim Li Rui's Diary Rights? (Part 2)

- State of Play in China:Why the CCP Desperately Wants to Reclaim Li Rui's Diary Rights? (Part 1)

- Why Are So Many People Homeless?